Salesforce’s recent earnings report revealed a mixed bag of results. On one hand, the cloud giant reported a robust Q4 performance—with revenue reaching $10 billion (an 8% increase year-over-year) and record-high operating cash flow—demonstrating strong operational fundamentals. On the other hand, the company’s forward guidance for fiscal 2026 disappointed investors, leading to a significant drop in extended trading.

At the heart of the discussion is Salesforce’s heavy focus on artificial intelligence, particularly its new AI-powered product, Agentforce. Designed to usher in a digital labor revolution by automating routine tasks and enhancing customer interactions, Agentforce has already secured 5,000 deals. However, its early revenue contribution remains modest, and the market has reacted with skepticism given the conservative outlook.

This post explores how Salesforce’s impressive Q4 fundamentals are currently being overshadowed by a weak future outlook and underwhelming early results from Agentforce, raising questions about the immediate impact of the company’s AI investments on its growth trajectory.

Background on Salesforce and Its Evolution

Founded in 1999, Salesforce has become the premier cloud-based CRM provider, transforming how companies manage customer relationships and streamline business operations. With its subscription-based SaaS model, the company quickly established itself as a leader in the cloud software market, offering scalable solutions that empower organizations of every size.

Over the years, Salesforce has evolved significantly beyond traditional CRM. Recognizing the rapidly changing digital landscape, the company has transitioned to an integrated strategy that fuses digital labor with artificial intelligence. This strategic pivot is evident in its suite of innovative products:

- Customer 360: This platform unifies disparate customer data across multiple channels, providing businesses with a comprehensive, real-time view of their customers. It has become the cornerstone for driving personalized engagement and deeper customer insights.

- Data Cloud: Serving as the engine behind advanced analytics and AI, Data Cloud consolidates massive amounts of data to support intelligent decision-making and fuel growth across Salesforce’s product ecosystem.

- Agentforce: As the latest addition to its portfolio, Agentforce represents Salesforce’s ambitious move into AI-powered digital labor. Designed to automate routine tasks and enhance operational efficiency, Agentforce is positioned to redefine how companies handle customer service and other core functions.

By continuously integrating these groundbreaking technologies, Salesforce is not only cementing its position as a market leader but also spearheading the digital labor revolution that is set to transform enterprise operations in the years ahead.

Overview of Q4 and Fiscal Year 2025 Performance

In its fourth quarter, Salesforce delivered a solid performance with revenue reaching $10 billion—a notable 8% increase year-over-year. This robust top-line growth was underpinned by record-high operating cash flow and free cash flow figures, reflecting the company’s disciplined cost management and efficient capital utilization.

A key component of this strong performance was the growth in subscription and support revenue, which continued to drive the recurring revenue base that is vital to Salesforce’s long-term business model. Although these results exceeded several internal benchmarks, the Q4 revenue fell slightly short of consensus estimates, which predicted a marginally higher figure. Additionally, margin improvements were evident, as both GAAP and non-GAAP operating margins saw positive shifts, highlighting the company’s ability to leverage scale while managing expenses effectively.

Overall, the Q4 and full-year 2025 performance paints a picture of a financially healthy company, even as its forward-looking guidance has prompted market caution.

Deep Dive into Agentforce

Agentforce is Salesforce’s latest venture into AI-powered digital labor—a tool designed to automate routine tasks and streamline customer interactions. As part of Salesforce’s broader AI strategy, Agentforce is intended to work in tandem with platforms like Customer 360 and Data Cloud to enhance operational efficiency and drive productivity gains across enterprises.

Since its launch, Agentforce has demonstrated promising early traction. The platform has already closed around 5,000 deals, with 3,000 of those being paid transactions—a clear indication of market interest and initial customer validation. Furthermore, Agentforce has handled approximately 380,000 conversations, achieving an impressive resolution rate of 84%, which highlights its capability to effectively manage customer inquiries and reduce the need for human intervention.

Despite these encouraging metrics, Salesforce has set modest expectations for Agentforce’s revenue contribution in fiscal 2026. This conservative outlook reflects the early stage of the product’s adoption cycle, as companies are still exploring and integrating the technology into their workflows. However, there is significant upside potential for fiscal 2027 as the tool matures and as more customers deploy and rely on Agentforce to drive efficiency and reduce operational costs.

Market Reaction and Guidance Concerns

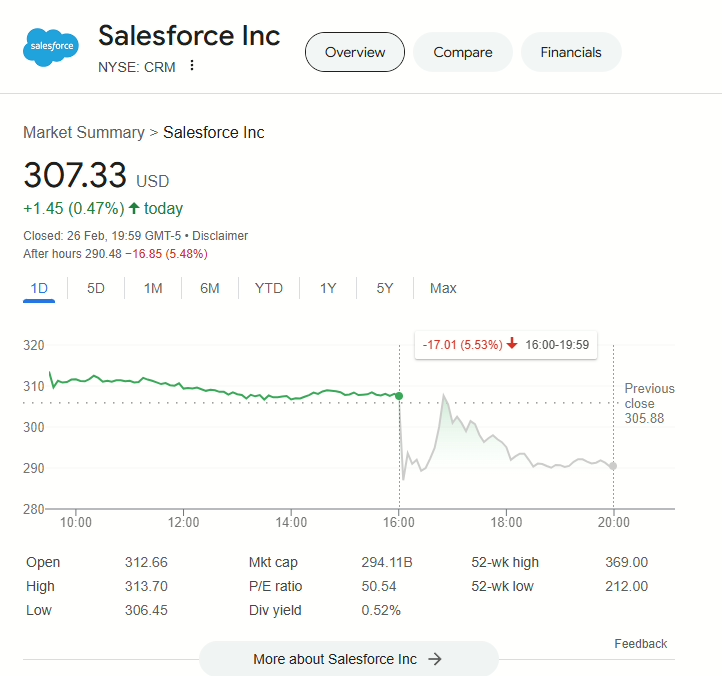

Despite solid operational performance in Q4—marked by strong revenue growth, record-high cash flows, and robust subscription metrics—Salesforce’s stock experienced a significant decline of over 5% in extended trading. This sell-off highlights the market’s cautious reaction, driven primarily by concerns over the company’s forward guidance and the modest short-term revenue impact anticipated from its new AI initiative, Agentforce.

Analyst commentary has been mixed. Some experts remain skeptical of early generative AI experiments and point out that the adoption cycle for Agentforce is still in its nascent stages. Concerns center around whether the technology can quickly translate into significant revenue gains without cannibalizing other parts of the business. In essence, while Salesforce’s fundamentals remain strong, investors are questioning if the company’s aggressive pivot toward digital labor can deliver on its promise in the near term.

Looking ahead to fiscal 2026, Salesforce has issued guidance that forecasts revenue between $40.5 billion and $40.9 billion—implying a growth rate of about 7% to 8%. This outlook also comes with expectations for steady growth in subscription and support revenue, alongside margin targets that include improved operating margins. However, these projections fell short of Wall Street expectations, leading to a reevaluation of the stock. The shortfall is largely attributed to the cautious stance on Agentforce’s immediate revenue contribution, as well as broader economic uncertainties affecting the professional services segment.

In summary, while Salesforce continues to deliver impressive Q4 results and remains on a strong financial footing, the conservative guidance for FY26 and uncertainty around the immediate impact of its AI-driven strategy have tempered investor enthusiasm, resulting in a notable drop in the stock price during extended trading.

Strategic Implications and Future Outlook

Salesforce’s bold push into digital labor and AI isn’t just a short-term experiment—it’s a core component of the company’s long-term growth strategy. By integrating advanced AI tools like Agentforce with its unified platform of Customer 360 and Data Cloud, Salesforce is positioning itself to drive transformational efficiencies and unlock new revenue streams over the coming years.

However, the path forward is not without challenges. Economic uncertainties continue to loom, potentially impacting enterprise spending and delaying technology adoption. Moreover, the early stages of Agentforce’s rollout come with inherent adoption risks: while early metrics are promising, its modest revenue contribution in FY26 signals that the full potential of digital labor may take time to materialize. Additionally, competitive pressures from other tech giants and emerging niche players in the AI and CRM spaces could intensify as the digital labor revolution accelerates.

On the upside, there is significant potential for improved revenue contributions as customer deployments expand and the partner ecosystem matures. As more organizations integrate Agentforce into their operations and as strategic partnerships strengthen, investors can expect to see a more substantial impact on Salesforce’s topline growth by fiscal 2027 and beyond.

Moving forward, investors should closely monitor:

- Adoption Metrics: Increases in the number of Agentforce deals, enhanced usage statistics, and the conversion of early trials into long-term contracts.

- Revenue Contributions: Shifts in how Agentforce begins to drive subscription revenue, particularly as its adoption cycle moves from early experimentation to broader deployment.

- Margin Improvements: Continued progress in operating margin expansion and cash flow generation as the integration of digital labor yields efficiency gains.

- Competitive Landscape: How Salesforce’s AI initiatives compare with those of its competitors, and whether emerging technologies can disrupt the current market dynamics.

Overall, while short-term guidance may appear cautious, Salesforce’s deep integration of digital labor and AI holds promising long-term implications for sustained growth and innovation.

Conclusion

Salesforce’s Q4 results underscore the company’s robust operational strengths—highlighted by solid cash flow, consistent revenue growth, and the successful integration of advanced AI capabilities. Innovations like Data Cloud and Agentforce are setting the stage for long-term transformation, even though the immediate revenue contribution from Agentforce remains modest and the revenue forecasts for FY26 are conservative compared to market expectations.

While current market concerns focus on short-term adoption risks and economic uncertainties, Salesforce’s strategic pivot toward digital labor and a unified AI-driven ecosystem positions it well for future growth. As the technology matures and customer deployments expand—bolstered by a strong partner ecosystem—investors may witness a more substantial revenue impact in the coming fiscal years.

What are your thoughts? Do you believe Salesforce’s innovative strategy will eventually outweigh its near-term challenges? Share your views on the future of AI-driven digital labor in the comments below.